- Rishabh's Crypto Newsletter

- Posts

- Crypto Leverage is Built Different

Crypto Leverage is Built Different

October's $73 Billion Crypto Liquidation Deep Dive

There is ~$74 billion in crypto debt outstanding (higher than crypto’s 2021 leverage peak). As someone who lived through FTX and Celsius in a visceral way (I worked at BlockFi), seeing that leverage number makes me sweat bullets.

The number is the same, but the machine underneath it has been completely rebuilt on DeFi rails. Before I explain why the structure has changed, let me illustrate the changes using the latest crypto liquidation event of October 2025 as a case study.

Note: Data and analysis derived from Galaxy Research's "State of Crypto Leverage – Q3 2025" report, supplemented by research on DeFi infrastructure (by emrecolako)

The Crypto Liquidation of October 10, 2025

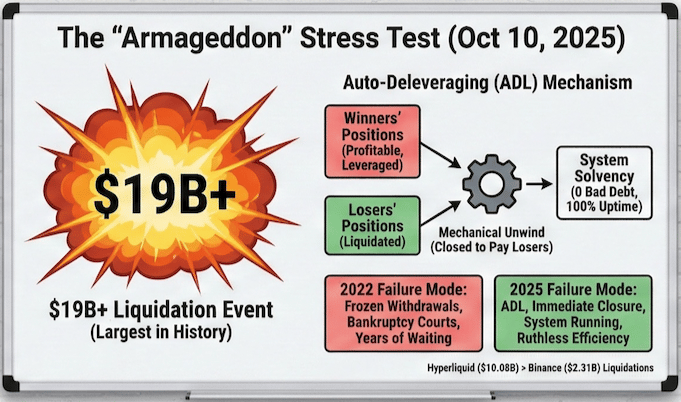

On October 10th, 2025, crypto experienced its largest liquidation event in history. Over $19 billion in perpetual futures positions were liquidated in a single day. Hyperliquid alone processed $10.08 billion. Bybit followed with $4.58 billion, Binance with $2.31 billion. Futures open interest collapsed 30% overnight and market makers withdrew liquidity from markets within hours.

The October 2025 deleveraging event exposed critical weaknesses in both CeFi and DeFi infrastructure, particularly around oracle mechanisms, auto-deleveraging (ADL) systems, and liquidity provision during stress periods.

Oracle Failure

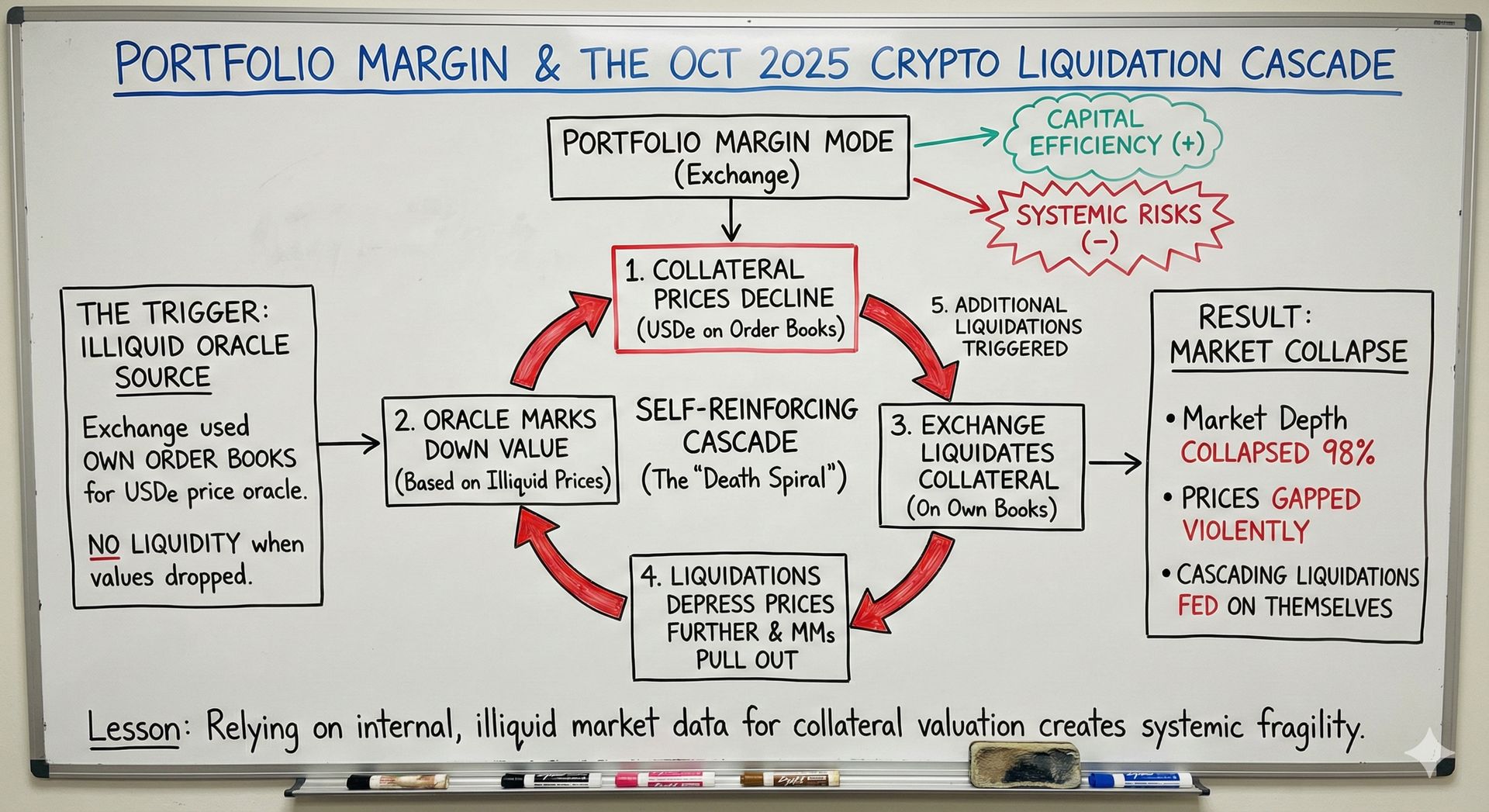

A well known exchange had a “portfolio margin mode” that allowed traders to cross-margin multiple assets in their portfolio, using them collectively as collateral for leveraged positions. This creates capital efficiency but introduces systemic risks when collateral values become unstable.

Unfortunately (like clockwork), collateral values become unstable on October 2025. An exchange was (allegedly) using their own order books as the data source for the price oracle for USDe, Ethena Labs’ yield-bearing stablecoin, that was being used as collateral for trades and leveraged positions. The collateral value of USDe started plummeting and there was no liquidity in the order book, which further reinforced the deleveraging.

This created a self-reinforcing cascade

Collateral prices for USDe declined on the exchange order books

The oracle marked down collateral values based on these illiquid prices

The exchange liquidated collateral on their own books

Liquidations further depressed prices and market makers pulled out of the market

Additional liquidations were triggered, continuing the cycle

As a result, market depth collapsed 98% in some pairs, prices gapped down violently, and cascading liquidations fed on themselves.

How was this resolved?

In 2022, when things broke, we got frozen withdrawals and bankruptcy courts. Creditors waited years to recover pennies on the dollar. Executives went to prison.

On October 10, 2025, we got auto-deleveraging. Hyperliquid triggered its ADL mechanism for the first time in over two years of operation. When liquidations couldn't clear at bankruptcy prices and the insurance fund was exhausted, the system identified traders on the opposite side of trades (those currently in profit) and forcibly closed their positions to offset the losses. Approximately 35,000 positions across 20,000 traders were mechanically unwound.

The algorithm ranked positions by unrealized profit and effective leverage. The biggest winners got closed first. Many were hedged positions where the ADL didn't recognize the hedge—it just saw a highly profitable short and closed it, leaving the unprotected long to get liquidated minutes later.

It was brutal (but it worked). It mechanically took money from winning traders to pay for loss positions.

Hyperliquid maintained 100% operation, zero bad debts, and publicly disclosed all liquidation data. The HLP vault made approximately $40 million in one hour by absorbing distressed positions at discounted prices and selling into the rebound. By the next morning, trading resumed normally.

That's the difference between 2021 and 2025. The risk hasn't disappeared - it has been redistributed from bankruptcy courts to algorithmic smart contracts.

The Quality Shift: 2021 vs. 2025

The headline numbers look similar. The underlying machinery is completely different.

2021 | 2025 | |

|---|---|---|

Total Leverage | $69.37B | $73.59B |

Collateralization | Optional (often absent) | Standard (required) |

Visibility | Opaque balance sheets | On-chain, real-time |

Credit Decisions | Relationship-based | Collateral-based |

Failure Mode | Insolvency → Bankruptcy | Liquidation → ADL |

Who Absorbs Losses | Unsecured creditors | Profitable counterparties |

DeFi Market Share | 48.6% | 66.9% |

Outcome of Stress | FTX, Celsius, Voyager bankrupt | System bends, doesn't break |

The previous cycle (2021) was built on uncollateralized lending, relationship-based credit decisions, and opaque balance sheets. Lenders extended credit based on reputation and yield promises rather than actual collateral. When the music stopped, there was nothing (or very little) backing the loans.

Today's market (2025) operates under an entirely different paradigm. Full collateralization is standard practice. On-chain protocols provide transparent, real-time visibility into lending positions. Mechanical liquidation systems replace discretionary credit decisions.

DeFi market share is up materially in 2025 (vs. 2021)

The other difference between the 2025 market and the 2021 market is the share of loans on DeFi protocols vs CeFi platforms.

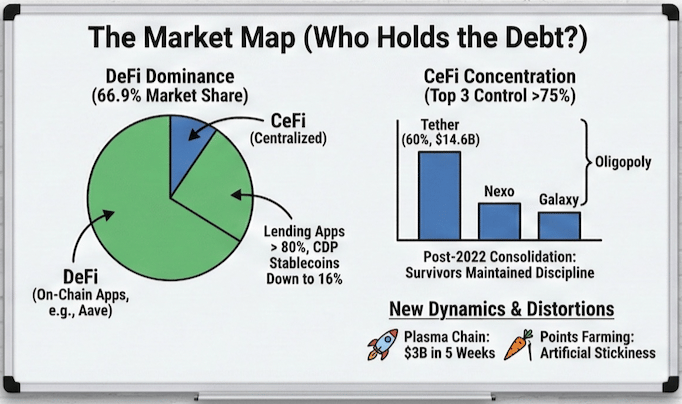

DeFi's Dominance (62.7% Market Share)

On-chain lending applications now command nearly two-thirds of the crypto lending market—an all-time high. At the end of Q4 2021, on-chain borrowing represented 48.6%. Today it's 66.9%.

Lending applications like Aave now account for over 80% of on-chain borrowing, while CDP stablecoins (like DAI) have fallen from 53% to 16%. Users are moving toward borrowing centralized stablecoins like USDT and USDC rather than minting synthetic ones.

CeFi Concentration (Top 3 Control >75%)

Tether dominates with a 60% market share ($14.6 billion in open loans), followed by Nexo and Galaxy. Together, the top three lenders control over 75% of tracked CeFi loans.

This concentration reflects post-2022 consolidation. The survivors are precisely the firms that maintained discipline during the mania.

However, DeFi still has weak points!

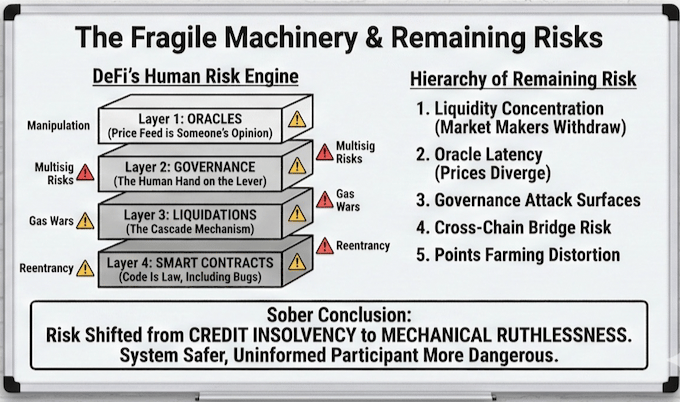

Here's the uncomfortable truth: DeFi is marketed as code-governed, but the real risk engine is often human in the background.

The infrastructure powering lending yields is a complex stack of interdependent components (smart contracts, oracles, governance multisigs, risk parameter committees, and liquidation bots) each with their own failure modes.

The risk is that the humans governing the code react too slowly (or incorrectly) market movements.

Layer 1: Oracles

Every DeFi lending protocol needs to know asset prices to determine when positions are undercollateralized. This information comes from oracles—off-chain data feeds pushed on-chain by third parties.

The problem is fundamental: blockchains can't verify real-world information, so they must trust external sources.

Aave and Compound rely on Chainlink's decentralized oracle network, which aggregates prices from at least seven independent node operators. Prices update when deviation crosses a threshold or after a time heartbeat. This architecture has held up well, but it's not immune to failure. The BIS summarizes it bluntly: oracle manipulation risks in DeFi may be worse than data reporting risks in traditional finance, because anonymity increases incentives for malicious behavior while making punishment difficult.

What's improved: Multi-oracle systems, time-weighted average prices (TWAPs) that resist manipulation, and circuit breakers that pause operations during extreme deviations. MakerDAO's OSM layer implements a one-hour delay for price updates. These trade responsiveness for safety.

Layer 2: Governance

"Decentralized" lending protocols aren't fully autonomous. They require constant parameter adjustment—loan-to-value ratios, liquidation thresholds, supply caps, interest rate curves. Someone has to make these decisions.

At Aave, Chaos Labs manages risk parameters across ten deployments, hundreds of markets, and thousands of variables. Their Risk Oracles automate some adjustments within governance-approved bounds, but the core decisions—which assets to list, what LTVs to allow, how to respond to market stress—still require human judgment.

"Decentralization" is often just "Democratized Risk Management."

During bootstrapping phases, most protocols are controlled by multisigs—groups of 3-7 keyholders who can execute changes without full governance votes. Aave's Avalanche deployment is controlled by an Avalanche community multisig. This is expedient but introduces centralization risk.

Aave's recent decision to hardcode USDe's price to $1 during a depegging event protected borrowers but shifted risk to stablecoin lenders. Governance intervened in a "trustless" system to pick winners and losers. That's a feature, not a bug—but it's a human feature.

Layer 3: Liquidations

When collateral values drop, positions must be liquidated to prevent bad debt. The process sounds simple—sell collateral, repay debt, return remainder to borrower—but execution is where things break.

Aave uses a Health Factor formula: if HF drops below 1, a position becomes liquidatable. Liquidators (typically bots) can repay up to 50% of the debt and receive the corresponding collateral plus a 5-10% bonus. This creates profit incentive and ensures positions get closed before they go underwater.

The problem emerges during sharp drops:

Thousands of positions hit liquidation thresholds simultaneously

Liquidation bots compete for transactions, driving gas fees above $1,000 per liquidation

As liquidators sell seized collateral, prices drop further

This triggers more liquidations, which triggers more selling

Liquidity drains from order books as market makers withdraw

With no liquidity to absorb sales, prices crash harder

On October 10th, Aave V3 Core on Ethereum experienced $192.86 million in liquidations—its third-highest day ever. Wrapped bitcoin tokens alone saw $82.17 million liquidated.

Layer 4: Smart Contracts

Smart contracts are immutable once deployed. If there's a vulnerability, it can't simply be patched—and the entire DeFi ecosystem can see the code.

Every major protocol undergoes multiple audits, but audits are informed opinions, not guarantees. There are still vulnerabilities that are exploited from time to time:

Reentrancy attacks: A contract calls an external contract before completing its state update, allowing manipulation (the 2016 DAO hack)

Flash loan exploits: Uncollateralized loans repaid within a single transaction can temporarily manipulate prices or exploit logic flaws

Composability risks: DeFi's "money lego" architecture means protocols depend on each other—Harvest Finance lost $34 million to an attack exploiting interactions between multiple contracts

The Hierarchy of Remaining Risk

October 10th validated the mechanical improvements, but revealed where fragility persists:

1. Liquidity Concentration When market makers withdrew, depth collapsed 98%. The problem isn't the protocols—it's the small number of sophisticated actors providing liquidity. When they step back simultaneously, prices gap violently regardless of how well-designed the liquidation mechanics are.

2. Oracle Latency When prices move faster than oracle heartbeats, on-chain prices diverge from reality. In May 2021, Compound's 15-minute delay prevented $100 million in unnecessary liquidations during a flash crash. The same delay could enable exploitation in different scenarios.

3. Governance Attack Surfaces Protocols remain vulnerable to governance manipulation. The intervention to hardcode USDe's price during depegging was necessary—but it demonstrated that "trustless" systems still require trusted judgment calls.

4. Cross-Chain Bridge Risk DeFi's expansion across multiple chains increases bridge dependencies. Bridges represent concentrated failure points—both from smart contract vulnerabilities and centralization in validator sets.

5. Points Farming Behavioral Distortion Users holding underwater positions to preserve airdrop allocations create artificial stickiness. When that stickiness breaks, exits can be abrupt and correlated.

Conclusion

Crypto leverage has returned to 2021 levels, but the systemic risk has shifted from credit insolvency (trusting humans who turned out to be frauds) to mechanical ruthlessness (trusting code that will liquidate you to save itself).

The system is safer for the system. The infrastructure can now process $19 billion in stress without creating bankruptcy cascades.

But it's more dangerous for the uninformed participant.

In 2022, when things broke, at least everyone knew it was broken. Withdrawals froze. Exchanges halted. The failure was visible.

In 2025, when things break, the system keeps running. Your profitable hedge gets ADL'd at the worst possible moment. Your position gets liquidated while you're asleep. The protocol survives. You don't.

The machine has replaced the handshake. And the machine is ruthless.

Disclaimer: The views and opinions expressed are solely those of the author and do not necessarily reflect those of the author's current employer. This material is for informational purposes only and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. The author is not responsible for errors, inaccuracies, or omissions of information; nor for the accuracy or authenticity of the information upon which it relies.